Wasatch County oversees the property tax functions required by the State of Utah within the county's boundary. The following elected officials, Surveyor, Recorder, Assessor, Auditor, Treasurer, and County Council, manage this property tax system. This page is dedicated to helping explain how Utah's property tax system works within Wasatch County. Below is the why, who, what, where, and how of the Utah State Property Tax system.

WHY?

Property taxes are an especially stable and reliable method for funding government services. Because they are reliable, they are typically used as the primary funding for local and essential services, such as schools, fire protection, and utilities. County governments in Utah are responsible for administering property tax on behalf of each taxing entity that benefits from it.

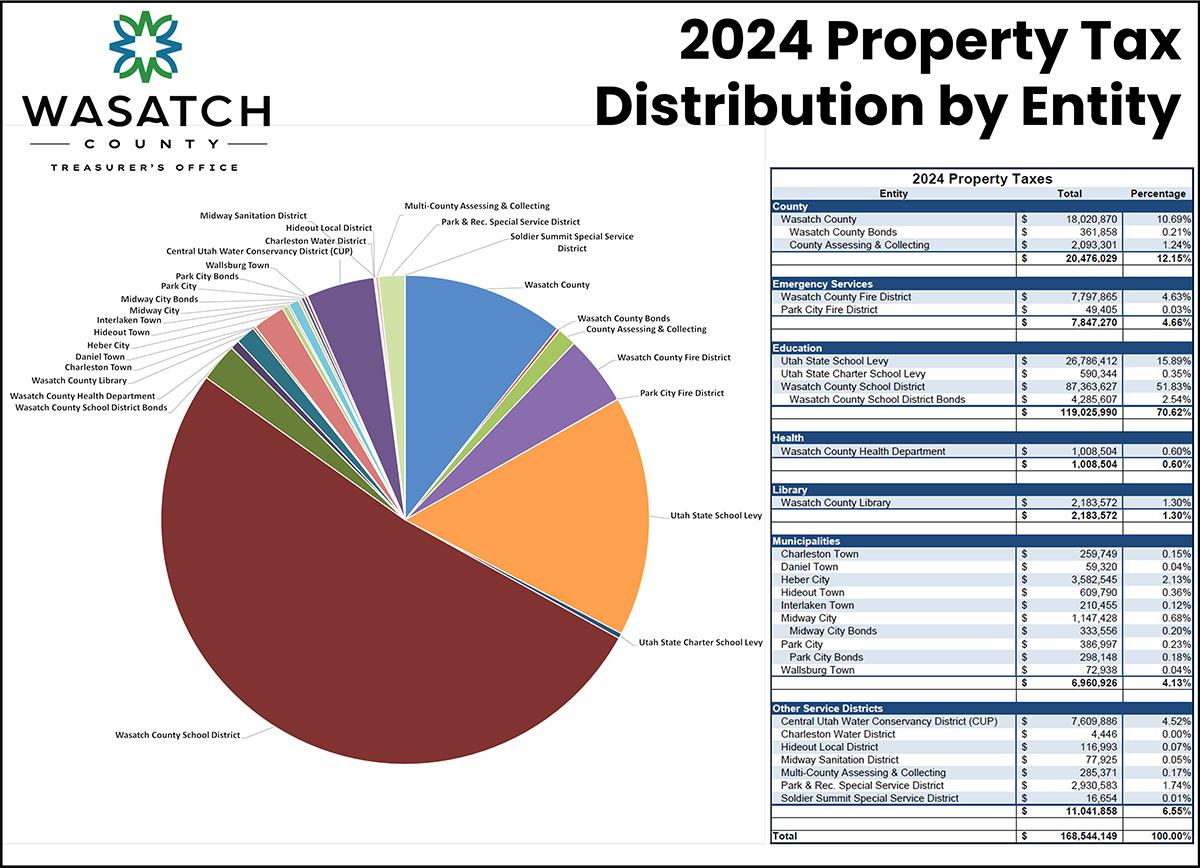

Wasatch County's role begins with the recording of real property ownership records. It continues with the valuation, assessment, and equalization of property values. It ends with the collection of property taxes and the distribution of revenues to the various local governmental entities.

2024 Wasatch County Property Tax Entities

WHO?

Wasatch County has an elected Surveyor, Recorder, Assessor, Clerk\Auditor, Treasurer, and County Council.

- The Surveyor preserves, maintains, and upgrades the Public Land Survey System (PLSS) and other government survey networks of corners and monuments that provide the basis of property ownership while ensuring that Records of Survey and subdivision plats correctly tie to these networks.

- The Recorder creates and maintains property ownership information and parcel maps.

- The Assessor is responsible for each property's market-based appraisal and assessment and generating the annual tax roll.

- The Clerk\Auditor applies tax rates and serves as clerk of the Board of Equalization (BOE).

- The Board of Equalization comprises theCounty Council, who hear appeals of the valuations and assessments entered on the tax roll by the Assessor.

- The Treasurer collects property taxes and distributes them to the various tax entities.

WHAT?

Property tax is based on the revenue needed for government services and the fair market value (the theoretical value at which the property would sell on the open real estate market) of real (generally, land and buildings), and personal property Generally what isn’t fixed to land, ie equipment, tools, computers, etc.), both commercial and residential. All property tax valuations are based on 100% of the fair market value, but the taxable value for residential real property is often the value after exemptions are applied.

The most common exemption is the primary residence exemption, and some residential properties in Wasatch County can also qualify for greenbelt or urban farming exemptions. Residential tax assessments do not consider personal property.

Valuation Types

- Commercial Property:

- Personal and Real property is assessed at 100% market value as of January 1st of each year.

- Residential Property:

- Real property is assessed at 100% market value as of January 1st of each year.

Valuation Exemptions

- Primary Residence Exemption:

- A 45% property tax exemption if you occupy your home for 183 or more consecutive days in a calendar year.

- Greenbelt Exemption:

- Utah Farmland Assessment Act allows agricultural land to be assessed based on its productive capacity rather than market value.

- Urban Farming Exemption:

- Parcels under 5 acres may be assessed based on its productive capacity rather than market value if certain conditions are met.

HOW?

Utah’s property taxes are managed by legislation commonly called Truth in Taxation. Truth in Taxation (1985) changed property tax from a rate-based tax to a revenue-based tax and requires all taxing entities to hold public hearings to increase revenues generated through property tax. Because Truth in Taxation holds each taxing entity’s revenue fixed, each property owner’s rates will fluctuate based on all property values throughout the County.

The Assessor reassesses properties on a regular schedule to keep valuations uniform and in keeping with fair market standards as required by the Utah Constitution, and the Clerk\Auditor calculates the property tax rate based on the entity's budget requirements and the total taxable value in the tax area. This short clip demonstrates how this works:

Your property valuation and tax notices will include the rates from each taxing entity applied to that property, the property valuation, and the date and time of all upcoming Truth in Taxation hearings to increase revenues for providing new services or keeping up with inflation. You can find this information online here.

WHERE?

Wasatch County offices are in the Administration Building at 25 N Main Street, Heber City, Utah 84032. Additional contact information for each office related to property taxes can be found here.

Wasatch County meeting schedules, agendas, minutes, and videos can be found at the Wasatch County Agenda site and Public Access site. Public meeting locations can be found on Utah’s public notice website and are publicly posted in the Wasatch County Administration Building.

The Assessor's Office staff visit properties throughout the county year-round.

WHEN?

Property owners are notified by mail of the valuation of their property, and notified again when taxes are due. Real property valuation notices are mailed in July based on the property’s value as of Jan 1. Real property tax notices are mailed in October, and payment is due no later than Nov 30th. These notices also contain dates and times for other parts of the tax process.

Important Annual Real Property Tax Dates:

January 1 | January 31 |

May 1 | May 22 |

July 22 | August 1 - September 1 Fiscal Budget Year Entities

|

August 1 - September 15 | October 30 Real Property Tax Notices are mailed from the Treasurer's Office (Property tax notices may contain additional special fees from other entities, such as outstanding charges for solid waste services, etc. Contains Truth in Taxation information for calendar budget year entities) |

November 30 | December 1 - December 31 Calendar Budget Year Entities

|