Why?

WHY?

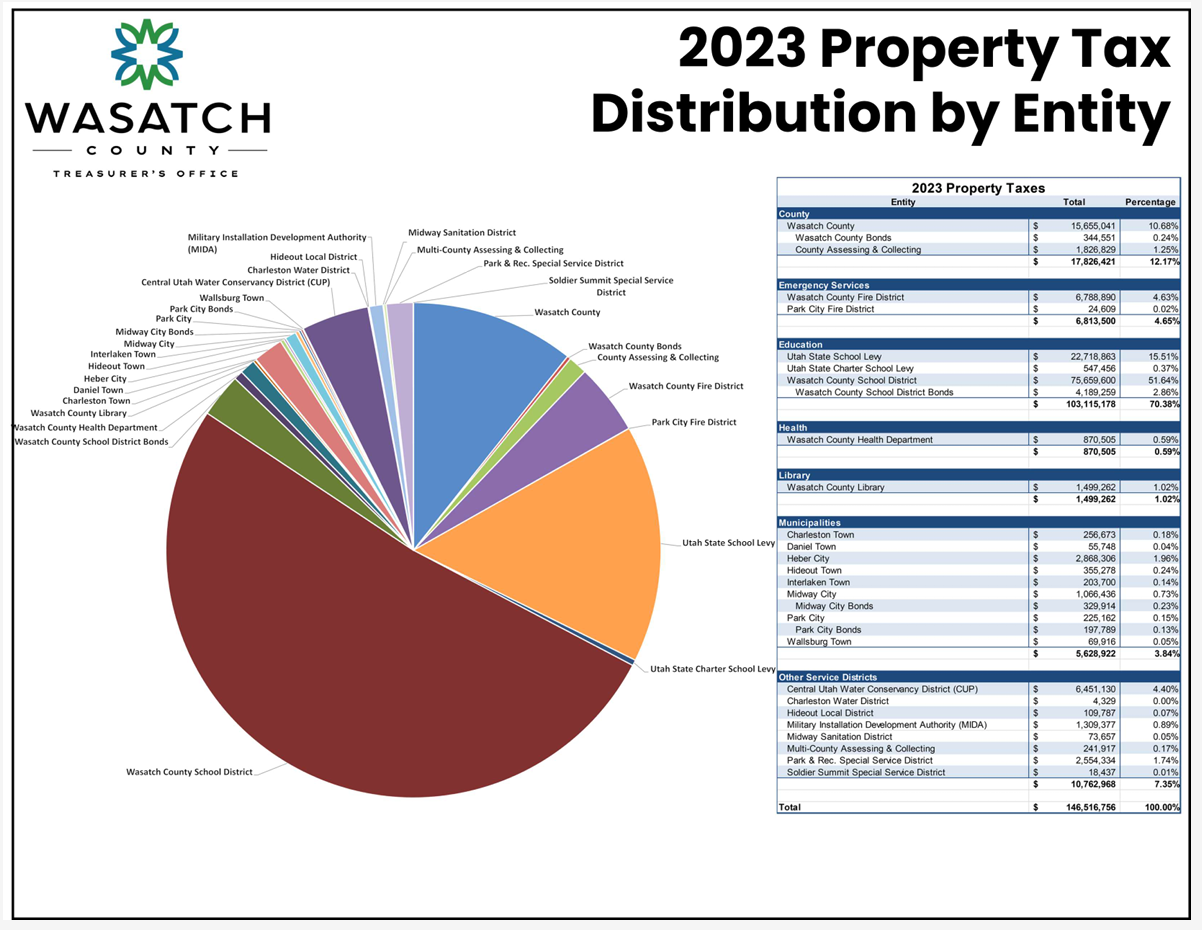

Property taxes are an especially stable and reliable method for funding government services. Because they are reliable, they are typically used as the primary funding for local and essential services, such as schools, fire protection, and utilities. County governments in Utah are responsible for administering property tax on behalf of each taxing entity that benefits from it.

Wasatch County’s role begins with recording of real property ownership records. It continues with the valuation, assessment, and equalization of property values. It ends with the collection of property taxes and the distribution of revenues to the various local governmental entities.

2023 Wasatch County Property Tax Entities